Panamanian Pandemonium

Panama police officers raided the offices of Mossack Fonseca Tuesday in an effort to find evidence of money laundering after the infamous Panama Papers leak, reports Agence France Presse and ABC News.

Javier Caravallo, a prosecutor specializing in tax evasion and money laundering, led several other prosecutors inside Mossack Fonseca’s headquarters in search of documents while police officers set up a perimeter outside. The office of Panama’s Attorney General issued a statement that Caravallo and the prosecutors utilized this “to obtain documentation linked to the information published in news articles that establish the use of the firm in illicit activities.” They added that the prosecutors also searched Mossack Fonseca’s other children companies and the local telephone company’s support center.

The information so far comprises of 2.6TB in emails, photographs, PDFs, spreadsheets, and entries from the company database. Altogether, they form 11.5 million files with links to heads of states, politicians, celebrities, and their associates.

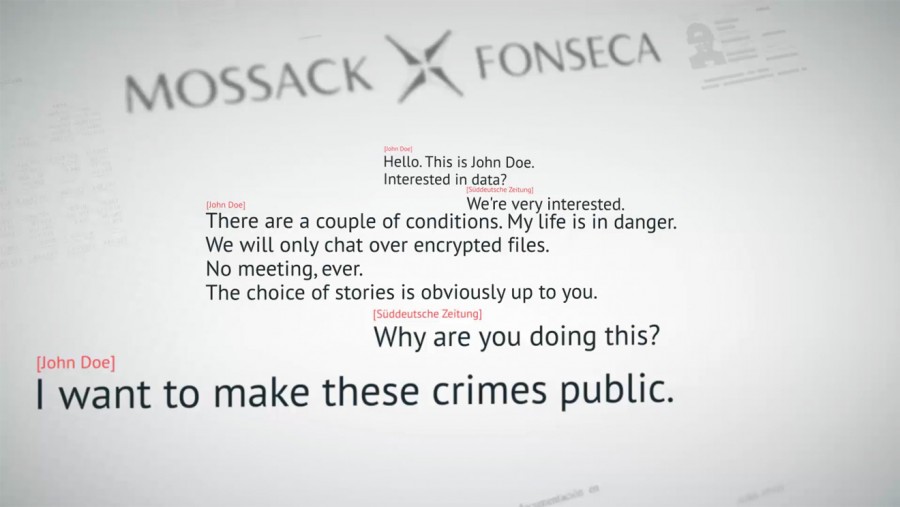

Süddeutsche Zeitung originally brought the leak to the attention of the International Consortium of Investigative Journalism, revealing just how many household names are a part of the shady offshore tax haven industry. The reports by the ICIJ and other outlets have led to the investigations of dozens of individuals who may have used Mossack Fonseca to avoid taxes.

While moving funds to an offshore account is based on very valid and logical reasoning (like protecting assets from an unstable government or keeping money out of banks that might crash and take the invested money with them), it has the potential to be used for illegal purposes. Money laundering and tax evasion remain a large issue in dealing with offshore funds, which is why Mossack Fonseca is currently under such close scrutiny.

The Panama-based law firm has continued to deny any allegations of wrongdoing, claiming that they ran background checks on clients and ensured that no illegal activities took place. The stories of some of their clients, however, tell a much different story. In 2010, their compliance department asked for a copy of Sheikh Abdulaziz al-Thani’s passport for verification. His Highness’ trust manager refused to hand over so much as a utility statement, yet they kept him as a client.

An infamous pedophile and sexual predator, millionaire Andrew Mogilyansky, was also one of the firm’s clients, something their compliance department only found out 6 years after the fact. To this day, Mogilyansky’s company is still open with Mossack Fonseco as the beneficiary company.

The Panama-based company has also previously been fined for their poor choice in associations, notably after the British Virgin Islands’ financial service commission found that one of Mossack Fonseco’s clients was Alaa Mubarak, son of Egypt’s exiled president. Two years prior, the EU had frozen both of their assets, yet Mubarak was using the law firm to circumvent the said restriction. Though Mossack Fonseco attempted to blame Credit Suisse for introducing the client, they were held responsible and fined for $37,500.

Roman Fonseca, co-founder of the firm, told the Associated Press, “Finally the real criminals are being investigated,” which echoes the company’s Twitter statement that they would continue to cooperate with Panamanian authorities to get to the bottom of this. Fonseca added that the only crime that came out of the leak was the hack itself, which the company suspects to have originated somewhere in Europe. “This is a tropical storm, like the ones we have here in Panama where once it passes the sun will come out,” he added in an interview with Reuters. “I guarantee you that we will not be found guilty of anything.”

This raid comes a week after a similar raid in San Salvador, after a Mossack Fonseca sign was removed from their office. Furthermore, the El Salvadorian branch isn’t listed on the law firm’s website, raising the suspicion of local authorities. According to Reuters, 20 computers were seized along with documents. In January, five brazilian Mossack Fonseca employee’s were accused with money laundering and corruption, and two of the total were charged. The Panama office has deflected criticism, stating that their Brazilian office (also not listed on their website) is an “independent entity” with its own staff.

Panamanian president Juan Carlos Varela has taken this opportunity to announce the creation of an international panel to create transparency in the Panamanian offshore finance industry, of which there are over 350,000 international business companies. Whether or not it will help the issue on a quantifiable level is up to speculation.

Hi! You must be really bored if you're reading this, but here we go. My name is Sebastian Lloret and I'm a Senior at Air Academy this year. I speak English,...