Adulting: The Senior’s Conundrum

Taxes, bills, and rent. Grocery shopping and college choices. Apartment searching and money-saving.

With graduation quickly approaching, these are the concerns on the minds of seniors. Most of us are eighteen, meaning legally, we are responsible for ourselves. Although we still live with our parents, most of us are moving out by next September, if not sooner.

I’ve only got $700 saved up, which doesn’t even cover a month of rent. I’m not ready. None of us are ready.

In May, after graduation, we’ll be fending for ourselves–and we’re going in blind.

But maybe we don’t have to.

The great thing about being an incoming adult in 2020 is our instant access to the internet. We have no shortage of resources to learn more about how to be an adult. From YouTube to Pinterest and even Instagram, adulting superstars are constantly sharing their tips and tricks on how to succeed.

It’s easy to feel the pressure to get it all figured out right away. We’ve lived with our parents all our lives. We’ve always had them backing us up.

Some of us have some money skills from part-time jobs and babysitting, but many high-schoolers spend money as quickly as they earn it, which doesn’t fly in adult life.

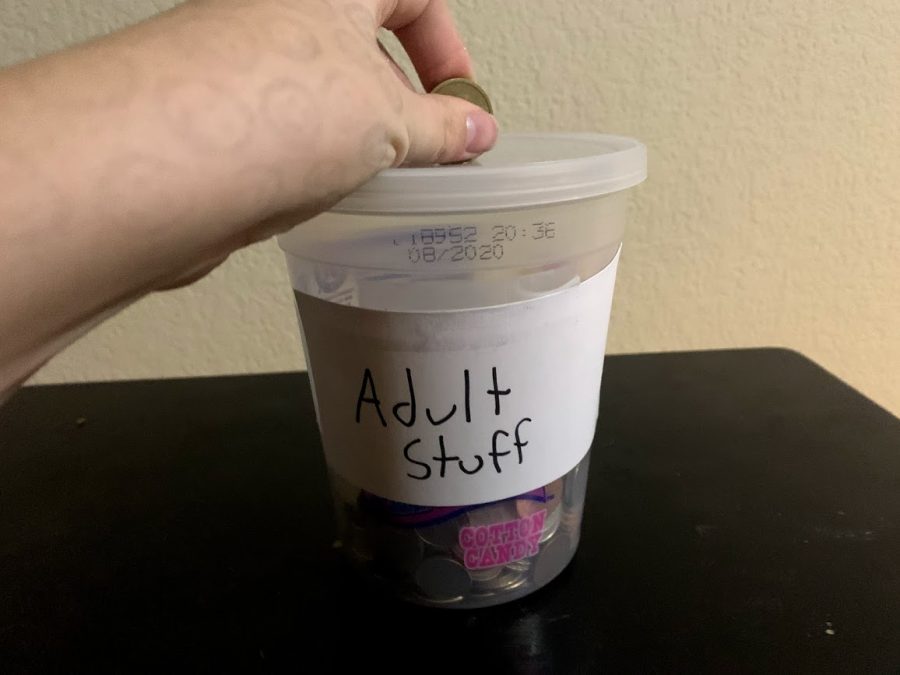

The biggest thing is saving money. Whether students are going to college, trade school or heading straight into the workforce, we’re starting with basically nothing and the expenses required for everyday life are bananas.

Gas money, groceries, rent, tuition, and bills all start to stack up really fast, but we also want to save and have a little money to spend on things we want.

“I’ll put 15% of every check straight into savings. I turn my savings off so I literally can’t even access it unless I go into the bank,” said Austin Fariss, a former Air Academy who graduated in 2019. “Every time I get another paycheck, whatever is remaining goes back into savings.”

Fariss works two jobs for a total of 55 hours a week and is saving up to buy a duplex with a friend.

In addition to saving money, it’s important to stay healthy. Frozen macaroni and cheese is good sometimes, but the healthiest way to eat is to cook for yourself.

But what do you cook in the first place?

Pinterest is a great place to find easy recipes that are inexpensive to make. The Jetstream Journal, and other news outlets, also write articles and blog posts about cooking on a budget, including this one.

Lastly, to make money, a job is required. There are tons of options, but finding a job that isn’t soul-sucking and laborious is difficult.

To get a job, especially when you have little to no experience, you have to do something to set yourself apart from the mass amount of other teenagers and young adults that are applying to the same positions.

You have to seem like the best, most interested candidate.

An employer is more likely to hire someone who appears to be eager to have the job. After submitting the application, wait a couple of days. Then, either call or even walk into the establishment and ask about the status of the application. Make sure to give your name so the hiring manager knows you’re interested.

Then, if you get a job, but it ends up being soul-sucking, you can always find a new one. The more experience you get, the easier it will be to get the next job.

While growing up might seem scary, with the help of the internet and experiences you’ll gain, adulting won’t be that hard.

Eyo! I'm Kailey. This is my second year on the Jetstream Journal staff. I love writing and plan to study Journalism in college. I love classic rock and...